Description

Certified Public Accountant (CPA) in the USA:

A Comprehensive Guide

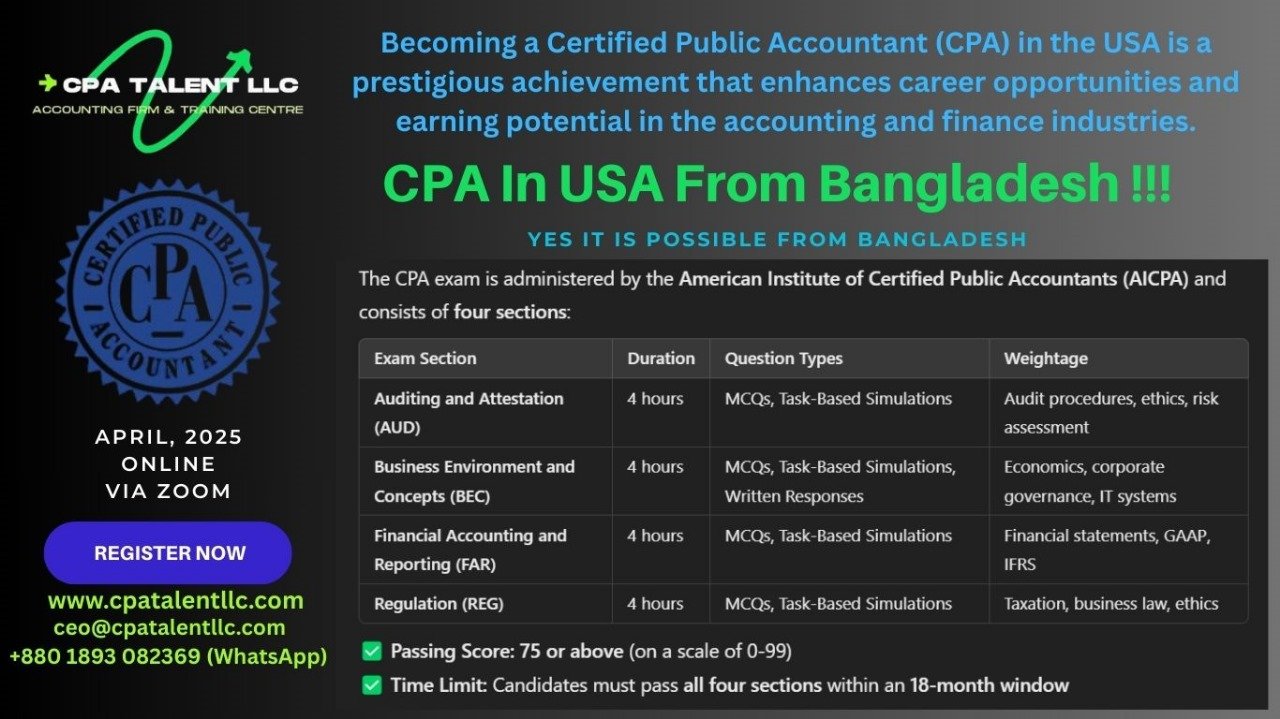

Becoming a Certified Public Accountant (CPA) in the USA is a prestigious achievement that enhances career opportunities and earning potential in the accounting and finance industries. Below is a step-by-step guide covering everything you need to know about the CPA designation, including eligibility requirements, registration, preparation, and the exam structure.

1. What is a CPA?

A Certified Public Accountant (CPA) is a professional accountant who has met the licensing requirements of a U.S. state board of accountancy. CPAs perform essential financial tasks, including auditing, tax preparation, and financial consulting.

Why Become a CPA?

- Higher earning potential (CPAs earn 10-15% more than non-CPAs).

- Increased job opportunities in public accounting, corporate finance, and government agencies.

- More credibility and recognition in the finance and accounting industry.

- Ability to sign audit reports and represent clients before the IRS.

2. CPA Exam & Licensure Requirements

Each state in the U.S. has its own licensing board, but most states follow similar CPA requirements:

-

Basic Requirements:

✅ Education: A bachelor’s degree (120-150 credit hours, depending on the state).

✅ Work Experience: Typically 1-2 years under a licensed CPA.

✅ CPA Exam: Must pass the Uniform CPA Exam (4 sections).

✅ Ethics Exam: Some states require passing an ethics exam.

Note: Some states allow candidates to sit for the CPA exam with 120 credit hours, but you will need 150 credit hours to obtain a CPA license.

3. CPA Exam Structure

The CPA exam is administered by the American Institute of Certified Public Accountants (AICPA) and consists of four sections:

| Exam Section | Duration | Question Types | Weightage |

|---|---|---|---|

| Auditing and Attestation (AUD) | 4 hours | MCQs, Task-Based Simulations | Audit procedures, ethics, risk assessment |

| Business Environment and Concepts (BEC) | 4 hours | MCQs, Task-Based Simulations, Written Responses | Economics, corporate governance, IT systems |

| Financial Accounting and Reporting (FAR) | 4 hours | MCQs, Task-Based Simulations | Financial statements, GAAP, IFRS |

| Regulation (REG) | 4 hours | MCQs, Task-Based Simulations | Taxation, business law, ethics |

✅ Passing Score: 75 or above (on a scale of 0-99)

✅ Time Limit: Candidates must pass all four sections within an 18-month window

4. CPA Registration Process

Step 1: Check Your State Board Requirements

-

Each state has slightly different CPA requirements.

-

Check the requirements for your state at the National Association of State Boards of Accountancy (NASBA) website.

Step 2: Submit the CPA Exam Application

-

Apply through your state’s Board of Accountancy.

-

Submit official transcripts from your university.

-

Pay the application fee ($100 – $250 depending on the state).

Step 3: Receive the Notice to Schedule (NTS)

-

After approval, you will receive an NTS, which allows you to schedule the CPA exam.

-

The NTS is valid for 6 months (varies by state).

Step 4: Schedule Your CPA Exam

-

Exams are conducted by Prometric Testing Centers.

-

You can take the CPA exam during the following testing windows:

-

Jan 1 – Mar 10

-

Apr 1 – Jun 10

-

Jul 1 – Sep 10

-

Oct 1 – Dec 10

-

5. CPA Exam Preparation

Recommended CPA Review Courses

The CPA exam is challenging, and using review courses significantly increases the chances of passing. Some top CPA prep courses include:

CPA Talent LLC (Most popular, endorsed by Big 4 firms)

How to Study for the CPA Exam?

- Create a study plan: Dedicate at least 15-20 hours per week for 3-6 months per section.

- Focus on weak areas: Use mock exams and performance analytics to identify weaknesses.

- Practice simulations: 50% of the CPA exam consists of task-based simulations (TBS).

- Join a CPA study group: Online forums and study groups help with motivation and knowledge sharing.

- Take multiple practice tests: Familiarize yourself with the exam format and timing.

6. CPA Exam Costs & Fees

The cost of the CPA exam varies by state, but below is an estimate:

| CPA Exam Fees | Estimated Cost (USD) |

|---|---|

| Application Fee | $100 – $250 |

| Exam Fee (Per Section) | $200 – $250 |

| Total Exam Fees (4 Sections) | $800 – $1,000 |

| Review Course Materials | $1,500 – $3,000 |

| Ethics Exam Fee (if required) | $150 – $200 |

| CPA License Fee | $50 – $500 |

Total estimated cost: $2,500 – $4,500

7. CPA License & Renewal

Once you pass the CPA exam, you must apply for a CPA license in your state. Requirements include:

✅ Completing 150 credit hours

✅ Fulfilling 1-2 years of work experience

✅ Passing an Ethics Exam (if required by your state)

CPA License Renewal & Continuing Professional Education (CPE)

- CPAs must renew their license every 1-3 years (varies by state).

- CPAs must complete 40 hours of Continuing Professional Education (CPE) per year.

8. Job Opportunities & Salary for CPAs in the USA

The CPA designation opens doors to high-paying jobs in public accounting, corporate finance, and government sectors.

-

Top Jobs for CPAs

-

Public Accountant (Big 4 firms: Deloitte, PwC, EY, KPMG)

-

Corporate Accountant (Financial Analyst, Internal Auditor)

-

Tax Consultant (Tax Planning, IRS Representation)

-

Government Accountant (FBI, SEC, IRS roles)

-

Chief Financial Officer (CFO)

-

Average CPA Salaries in the USA

Job Title |

Average Salary (USD) |

|---|---|

Entry-Level CPA |

$55,000 – $70,000 |

Mid-Level CPA |

$75,000 – $120,000 |

Senior Accountant |

$90,000 – $150,000 |

CFO |

$150,000 – $300,000+ |

Is CPA Worth It?

✅ If you want to advance your career in accounting, finance, or auditing, becoming a CPA is 100% worth it.

✅ It requires dedication, financial investment, and rigorous preparation, but the long-term benefits (higher salary, career growth, and job security) make it an excellent choice.

1. How to Choose the Right CPA Review Course?

✅ If you want Big 4-level material & structured coaching → Choose CPA Talent LLC

✅ If you want lifetime access & affordable material → Choose CPA Talent LLC

✅ If you prefer self-study & affordability → Choose CPA Talent LLC

✅ If you want AI-powered adaptive learning → Choose CPA Talent LLC

✅ If you need engaging & entertaining lectures → Choose CPA Talent LLC

2. CPA Exam Tips & Study Plan

To pass the CPA exam, consistency is key. Follow this plan:

📅 Study Plan (4-6 Months Per Section)

-

Week 1-2: Read study material, watch video lectures.

-

Week 3-5: Solve multiple-choice questions (MCQs) and task-based simulations (TBS).

-

Week 6-7: Revise weak topics, take full-length practice tests.

-

Week 8: Final review, mock exams, and last-minute revisions.

🔹 Study at least 15-20 hours per week.

🔹 Focus on practice questions and simulations (50% of the exam).

🔹 Use mnemonics and flashcards for tricky concepts.

🔹 Join CPA forums for motivation and discussion.

3. CPA License Renewal & Continuing Education

After passing the CPA exam, you must maintain your license:

🔸 CPA License Renewal: Every 1-3 years (varies by state).

🔸 CPE Requirements: 40 hours per year (varies by state).

🔸 CPE Topics: Accounting, Auditing, Ethics, Taxation, Technology.

🔸 CPE Providers: AICPA, Becker, Surgent, LinkedIn Learning.

Final Thoughts

📌 The CPA is one of the most valuable accounting certifications in the USA.

📌 Choose the right study materials based on your budget & learning style.

📌 Follow a structured study plan and use mock exams to pass.

📌 Check your state’s specific CPA requirements at NASBA before applying.

Would you like to take help choosing a CPA course from Bangladesh?

From Bangladesh is it possible???

Yes, it is possible for candidates from Bangladesh to become a CPA (Certified Public Accountant) in the USA. However, there are specific requirements and challenges you need to consider.

How to Become a CPA in the USA from Bangladesh?

1. Check CPA Eligibility Requirements for International Candidates

Since CPA exams are conducted in the USA, international candidates (including those from Bangladesh) must meet the education and experience requirements of a U.S. state board.

🔹 Education Requirement:

-

You must have a bachelor’s degree in accounting or finance from a recognized university.

-

The CPA requires 150 credit hours of education.

-

If your bachelor’s degree is only 120 credit hours, you may need to complete an extra diploma, master’s, or additional courses to meet the 150-hour requirement.

🔹 Experience Requirement:

-

Most states require 1-2 years of relevant accounting experience under a licensed CPA supervisor.

-

This experience can be gained outside the USA, but some states require it to be within the USA.

🔹 Ethics Exam:

-

Some states require an ethics exam after passing the CPA exam.

✅ Solution: Check which U.S. state allows international candidates to sit for the CPA exam with 120 credit hours and work experience from outside the USA.

2. Select a U.S. State for CPA Licensing

Each U.S. state has different CPA requirements, and not all states accept international candidates.

🔹 Best U.S. States for International CPA Candidates:

These states have more flexible rules for foreign applicants:

✔ Illinois (Accepts 120 credit hours)

✔ Montana (No U.S. residency required)

✔ New Hampshire (Allows foreign degrees, requires 120 credit hours)

✔ Colorado (No Social Security Number required)

3. Get Your Foreign Degree Evaluated

Since your degree is from Bangladesh, it must be evaluated by a recognized agency to check if it meets U.S. CPA requirements.

🔹 Top Agencies for Degree Evaluation:

✔ NASBA International Evaluation Services (NIES)

✔ World Education Services (WES)

✔ Foreign Academic Credentials Service (FACS)

📌 Tip: NASBA’s NIES is the most recommended for CPA evaluation.

4. Apply for the CPA Exam as an International Candidate

Once your degree is evaluated, follow these steps:

✔ Step 1: Submit a CPA exam application through the selected U.S. state board.

✔ Step 2: Pay the exam fee (approx. $200 – $250 per section).

✔ Step 3: Receive the Notice to Schedule (NTS) after approval.

✔ Step 4: Schedule your exam through Prometric.

5. Where Can You Take the CPA Exam? (Exam Centers for Bangladesh Candidates)

You can take the CPA exam in Bangladesh OR at international Prometric centers in:

📌 Available International CPA Exam Centers (Nearby to Bangladesh):

✔ India (Hyderabad, Ahmedabad, Mumbai, Chennai, Bangalore, Kolkata, New Delhi)

✔ UAE (Dubai, Abu Dhabi)

✔ Nepal (Kathmandu)

✔ Saudi Arabia, Bahrain, Egypt, Lebanon

✅ You DO NOT need to travel to the USA to take the exam if you choose one of these international locations.

-

6. Pass the CPA Exam & Meet Experience Requirements

The CPA exam has 4 sections:

✔ Auditing and Attestation (AUD)

✔ Business Environment and Concepts (BEC)

✔ Financial Accounting and Reporting (FAR)

✔ Regulation (REG)

🔹 Time Limit: You must pass all 4 sections within 18 months.

🔹 Passing Score: 75 or above on a scale of 0-99.

📌 Experience Requirement (After Exam):

-

Some states allow international experience to fulfill CPA requirements.

-

If needed, you can gain experience remotely or through U.S. firms in Bangladesh.

7. Apply for a CPA License

After passing the CPA exam, you need to:

✔ Complete the ethics exam (if required by your state).

✔ Meet the work experience requirement (1-2 years under a CPA).

✔ Submit a licensing application to your state board.

8. Maintain Your CPA License

✔ Renew CPA License: Every 1-3 years (varies by state).

✔ Complete Continuing Professional Education (CPE): 40 hours per year (varies by state).

-

CPA Exam Costs for Bangladesh Candidates

| Fees | Estimated Cost (USD) |

|---|---|

| Degree Evaluation (NIES, WES) | $200 – $400 |

| CPA Exam Application Fee | $100 – $250 |

| CPA Exam Fee (Per Section) | $200 – $250 |

| CPA Exam Total (4 Sections) | $800 – $1,000 |

| Ethics Exam (If required) | $150 – $200 |

| CPA License Fee | $50 – $500 |

| CPA Review Course (Optional) | $1,500 – $3,000 |

📌 Total Estimated Cost: $2,500 – $4,500

Is CPA Worth It for Bangladesh Candidates?

✅ Higher Salary: CPAs earn $75,000 – $150,000+ per year in the USA.

✅ Work Remotely: Many U.S. companies hire remote accountants with CPA certification.

✅ Global Recognition: A CPA license improves job opportunities in Big 4 firms, multinational companies, and remote accounting roles.

✅ Career Growth: You can work as a Financial Analyst, Tax Consultant, CFO, or Audit Manager.

📌 If you want to work remotely for a U.S. company as an accountant, CPA is one of the best certifications to have.

Final Steps for Bangladesh Candidates

✔ Check your state’s CPA requirements on NASBA’s website.

✔ Get your degree evaluated by NASBA NIES or WES.

✔ Apply for the CPA exam and take it at an international exam center (India, UAE, Nepal, etc.).

✔ Pass all 4 sections within 18 months.

✔ Complete the work experience requirement.

✔ Apply for the CPA license and maintain it with CPE credits.

Need Help Choosing the Right State or CPA Review Course?

Would you like me to recommend the best state for you based on your education & experience? Or help you select the best CPA study materials?

To recommend the best U.S. state for CPA eligibility and the best CPA review course for you, I need a little more information about your education and experience.

1. Education Background

-

Do you have a Bachelor’s degree in Accounting, Finance, or Business?

-

How many credit hours does your degree have? (Most Bangladeshi degrees are 120 credit hours, but CPA requires 150 in most states.)

-

Have you completed a Master’s degree, ACCA, CA, or any additional courses?

2. Work Experience

-

Do you have accounting or auditing experience?

-

Have you worked under a licensed CPA? (Some states require this for licensing.)

3. Career Goal

-

Do you want to work remotely for a U.S. company?

-

Are you looking to move to the USA in the future?

Once I have these details, I’ll suggest:

✔ The best U.S. state for your CPA application

✔ Whether you need extra courses to meet the 150-hour rule

✔ The best CPA review course based on your study style & budget

1. Selecting the Best U.S. State for CPA Application

Since most states require 150 credit hours and you likely have 120 credit hours, you have two options:

- Option 1: Choose a State That Accepts 120 Credit Hours for CPA Exam

Some states allow candidates to sit for the CPA exam with only 120 credit hours but require 150 hours for licensing.

✔ Best States for You:

- Montana (No U.S. residency required)

- Illinois (Accepts foreign degrees & allows 120 hours for the exam)

- New Hampshire (Flexible rules for international candidates)

- Colorado (No U.S. Social Security Number required)

✅ Recommendation: Choose Montana or Illinois because they have flexible international requirements and allow foreign work experience later.

- Option 2: Complete Additional 30 Credit Hours Before CPA License

Since CPA requires 150 credit hours for licensing, you can:

✔ Take extra online accounting courses from U.S. universities to complete 150 hours.

✔ Some U.S. universities offer affordable online courses for international students (like University of North Alabama, Walden University).

📌 If you don’t want to study extra courses right now, go with Montana or Illinois, take the CPA exam, and complete the hours later.

2. Getting Your Degree Evaluated

Before applying, you must evaluate your Bangladeshi degree with a recognized agency.

✔ Best Evaluation Service:

- NASBA International Evaluation Services (NIES)

- World Education Services (WES)

✅ Recommendation: Use NASBA NIES since it’s specifically designed for CPA candidates.

3. Applying for the CPA Exam

Once your evaluation is done:

✔ Choose a state board (Montana, Illinois, etc.)

✔ Apply for the CPA exam through NASBA

✔ Pay the exam fees and get your Notice to Schedule (NTS)

✔ Schedule your exam at an international testing center (India, UAE, Nepal, etc.).

4. Where to Take the CPA Exam? (Best Exam Centers Near Bangladesh)

You DO NOT need to travel to the USA! You can take the CPA exam in:

✔ India (Hyderabad, Ahmedabad, Mumbai, Chennai, Bangalore, Kolkata, New Delhi)

✔ UAE (Dubai, Abu Dhabi)

✔ Nepal (Kathmandu)

📌 Recommended Exam Center: If possible, take the exam in India (more locations & lower travel cost).

5. CPA Study Plan & Best Review Course for You

Since you don’t have CPA experience yet, choose a CPA review course that gives detailed explanations and practice questions.

✔ Best CPA Review Courses for You:

CPA Talent LLC – Best for structured learning, used by Big 4 firms.

– Best for self-study & detailed practice.

– Best for AI-based adaptive learning.

📌 Recommended Course:

- If you prefer guided coaching → CPA Talent LLC

- If you want affordable, detailed materials → CPA Talent LLC

- If you need fast preparation → CPA Talent LLC

6. Work Experience Requirement for CPA License

Since you have no experience under a CPA, you need 1-2 years of relevant work experience to get licensed.

🔹 Best Options for You:

✔ Gain remote accounting experience from a U.S. company.

✔ Work for a Big 4 firm (PwC, EY, Deloitte, KPMG) or a U.S.-based accounting firm in Bangladesh.

✔ Some states allow alternative work experience (like Montana).

📌 Tip: After passing the CPA exam, you can apply for remote CPA jobs with U.S. companies to fulfill this requirement.

7. Final Steps & Cost Breakdown

| Step | Estimated Cost (USD) |

|---|---|

| Degree Evaluation (NIES, WES) | $200 – $400 |

| CPA Exam Application Fee | $100 – $250 |

| CPA Exam Fee (Per Section) | $200 – $250 |

| CPA Exam Total (4 Sections) | $800 – $1,000 |

| CPA Review Course (Optional) | $1,500 – $3,000 |

| CPA Ethics Exam (If Required) | $150 – $200 |

| CPA License Fee | $50 – $500 |

📌 Total Estimated Cost: $2,500 – $4,500

Next Steps for You ✅

✔ Step 1: Choose a state (Montana or Illinois)

✔ Step 2: Get your degree evaluated (NASBA NIES recommended)

✔ Step 3: Apply for the CPA exam & schedule it in India, UAE, or Nepal

✔ Step 4: Choose a CPA review course (CPA Talent LLC)

✔ Step 5: Gain 1-2 years of accounting experience remotely or at a U.S. firm

Final Thoughts

✅ Yes, you CAN become a CPA from Bangladesh!

✅ You can take the exam in India/UAE/Nepal, so no need to travel to the USA.

✅ Choose Montana or Illinois for an easier application process. If possible!

✅ Use NASBA NIES for foreign degree evaluation.

✅ Gain remote experience with a U.S. firm after passing the exam.

- Best CPA Review Courses for You

Here are the top CPA review courses, with pros and cons for each:

Reviews

There are no reviews yet.