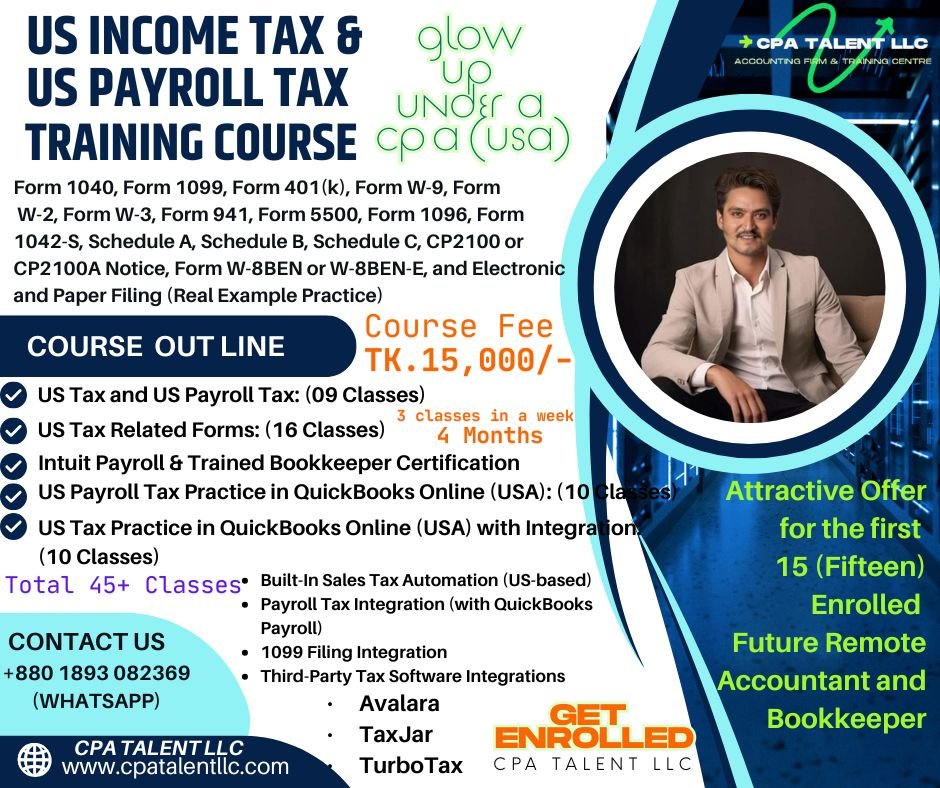

US Income & Payroll Tax under IRS Rules and Regulations.

Original price was: 25000 ৳ .15000 ৳ Current price is: 15000 ৳ .

Attractive Offer for the first 15 (Fifteen) Enrolled Future Remote Accountants and Bookkeepers. They will get the Opportunity to work with CPA Talent LLC (An Accounting Firm and Training Center), Team Wise, and also will get IRS tax volunteers training under the supervision of MD. Raihan Hasan, CPA (USA); CEO, CPA Talent LLC.

This comprehensive course is designed to equip learners with in-depth knowledge and hands-on skills in U.S. income and payroll tax systems as per IRS regulations. Across 45+ classes, it covers core concepts such as Tax & Payroll Accounting under US GAAP, tax credits, deductions, exemptions, FICA/FUTA, and the 2025 tax law updates. Students will gain practical experience with essential IRS forms (1040, W-2, 1099, 941, etc.), electronic filing, and real-world application through QuickBooks Online, including tax software integrations like Avalara and TurboTax. Ideal for aspiring tax professionals, bookkeepers, and accountants aiming to master U.S. tax compliance and payroll processing. Certification support included.

Description

Attractive Offer for the first 15 (Fifteen) Enrolled Future Remote Accountants and Bookkeepers. They will get the Opportunity to work with CPA Talent LLC (An Accounting Firm and Training Center), Team Wise, and also will get IRS tax volunteers training under the supervision of MD. Raihan Hasan, CPA (USA); CEO, CPA Talent LLC.

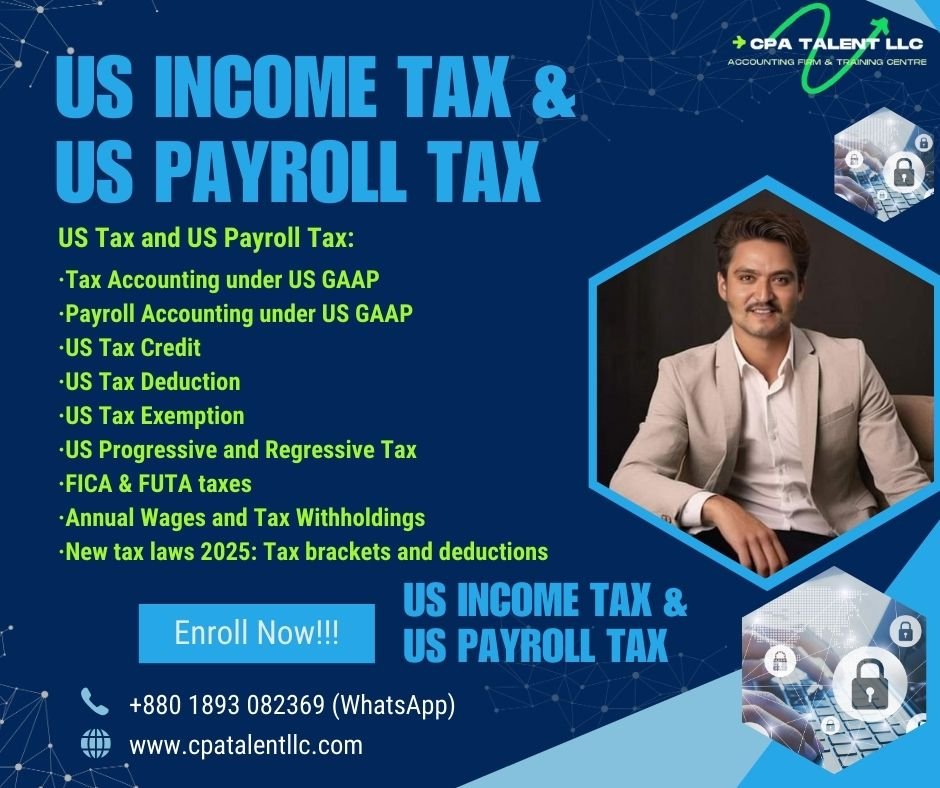

US Tax and US Payroll Tax: (09 Classes)

* Tax Accounting under US GAAP

* Payroll Accounting under US GAAP

* US Tax Credit

* US Tax Deduction

* US Tax Exemption

* US Progressive and Regressive Tax

* FICA & FUTA taxes

* Annual Wages and Tax Withholdings

* New tax laws 2025: Tax brackets and deductions

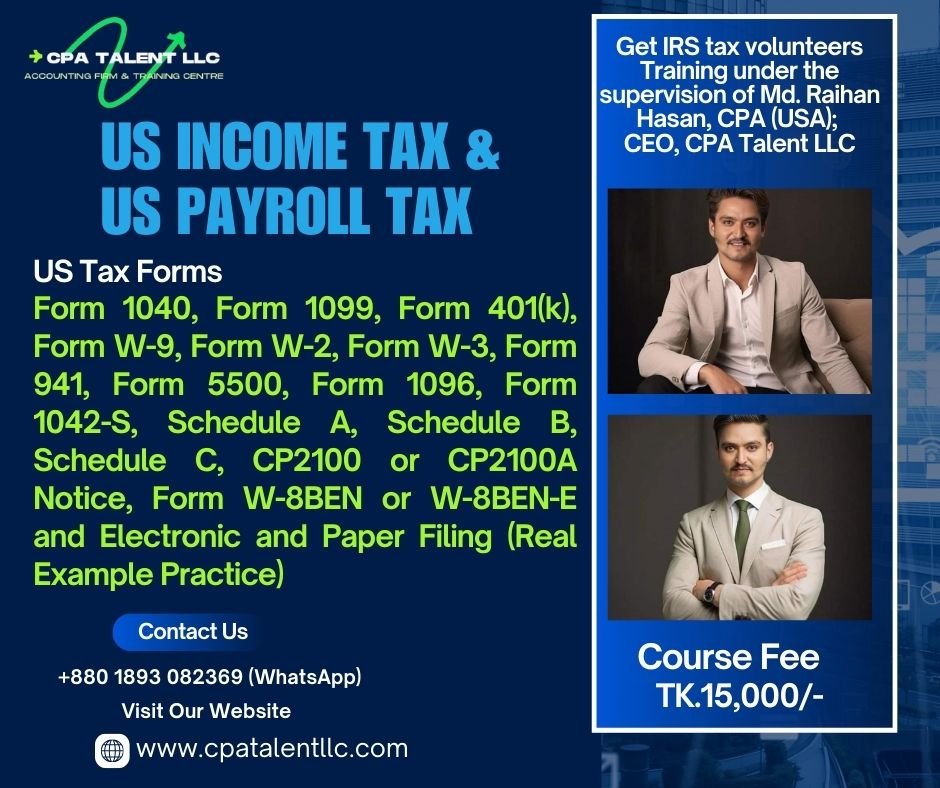

US Tax Related Forms: (16 Classes)

* Form 1040

* Form 1099

* Form 401(k)

* Form W-9

* Form W-2

* Form W-3

* Form 941

* Form 5500

* Form 1096

* Form 1042-S

* Schedule A

* Schedule B

* Schedule C

* CP2100 or CP2100A Notice

* Form W-8BEN or W-8BEN-E

* Electronic and Paper Filing (Real Example Practice)

US Payroll Tax Practice in QuickBooks Online (USA): (10 Classes)

* Getting started with US Payroll

* Managing workers

* Wages and taxes

* Deductions and contributions

* Tax liabilities and end-of-period activities

US Tax Practice in QuickBooks Online (USA) with Integration: (10 Classes)

* Built-In Sales Tax Automation (US-based)

* Payroll Tax Integration (with QuickBooks Payroll)

* 1099 Filing Integration

* Third-Party Tax Software Integrations

Avalara

TaxJar

TurboTax

* Integration for Income Tax Planning

Certification: (Mentor 100% Assist you to live to qualify) (Time based on Ur Demand)

* QuickBooks Online (USA) Payroll Certification

* Intuit Trained Bookkeeper Certification

* IRS tax volunteers training under the supervision of a CPA (USA)

Reviews

There are no reviews yet.