Description

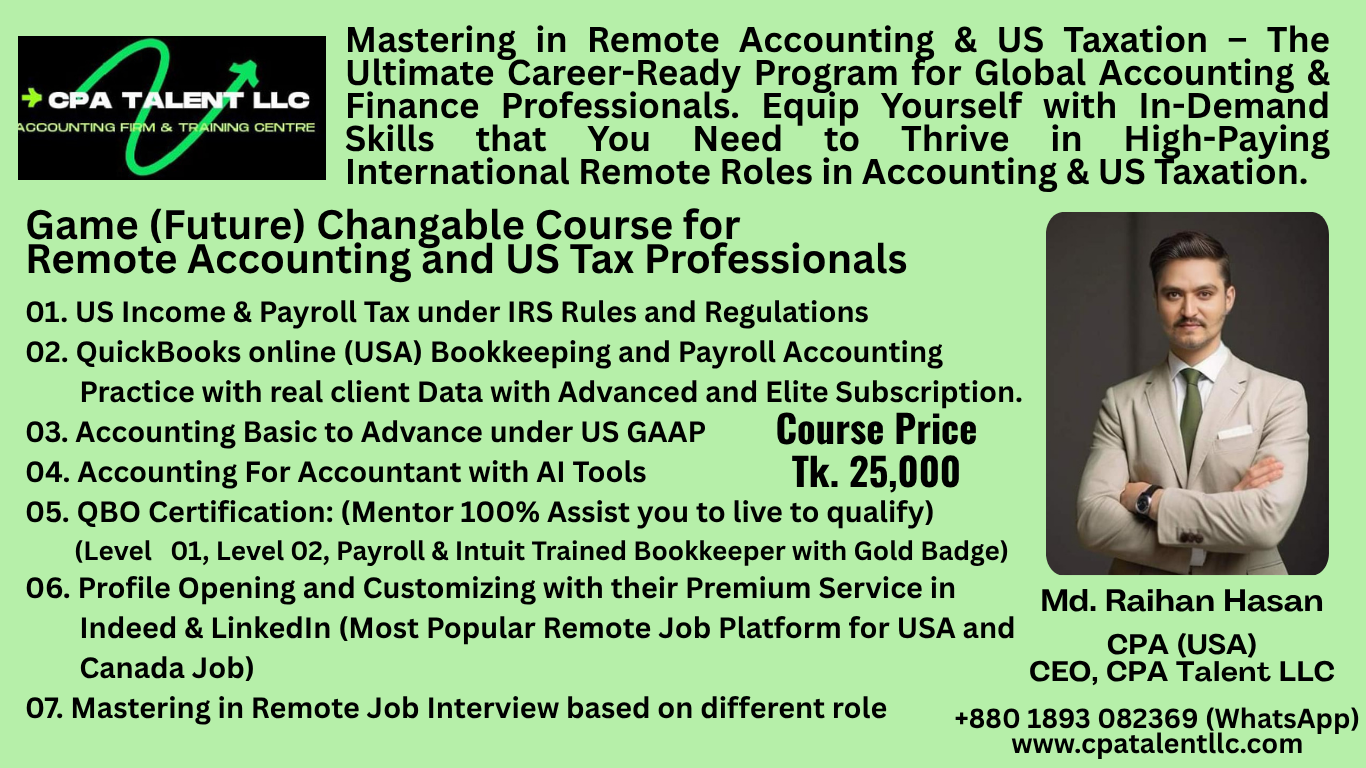

HERE is OUR COURSE OUTLINE:

-

US Income & Payroll Tax under IRS Rules and Regulations

-

US Tax and US Payroll Tax:

- Tax Accounting under US GAAP

- Payroll Accounting under US GAAP

- US Tax Credit

- US Tax Deduction

- US Tax Exemption

- US Progressive and Regressive Tax

- FICA & FUTA taxes

- Annual Wages and Tax Withholdings

- New tax laws 2025: Tax brackets and deductions

-

US Tax Related Forms:

Individual Tax

- Form 1040 – Primary form for individuals.

- Schedule A – Itemized deductions.

- Schedule B – Interest and dividend income.

- Schedule C – Profit or loss from business (sole proprietorship).

- Schedule D – Capital gains and losses.

- Schedule SE – Self-employment tax.

Self-Employed Tax

- Form 1040 – Primary form for reporting income.

- Schedule C – Report business income and expenses.

- Schedule SE – Self-employment tax.

- Form 8829 – Home office deduction (if applicable).

Sole Proprietorship

- Form 1040 – Filed with owner’s individual return.

- Schedule C – Report business operations.

- Schedule SE – Self-employment tax.

- Single-Member LLC

- Form 1040 – Reported as a disregarded entity.

- Schedule C – Used to report income and deductions.

- Schedule E/F – Depending on activity type (rental/farming).

- Multi-Member LLC

- Form 1065 – Partnership return.

- Schedule K-1 (1065) – Issued to each member for their share.

- Schedule M-1, M-2 – Reconciliation and capital tracking.

- Partnership Firm

- Form 1065 – Reports income and deductions.

- Schedule K-1 (1065) – Issued to each partner.

- Schedule M-3 – Reconciliation for large partnerships (if applicable).

C Corporation

- Form 1120 – Corporate income tax return.

- Schedule C – Dividends and deductions.

- Schedule M-1, M-2 – Reconciliation and retained earnings.

S Corporation

- Form 1120-S – S Corp income tax return.

- Schedule K-1 (1120-S) – Passed-through income to shareholders.

- Schedule K – Summary of income/deductions.

- Form 2553 – Election to be treated as an S Corporation.

Nonprofit Organization

- Form 990 – Return of Organization Exempt from Income Tax.

- Form 1023/1024 – Application for exempt status.

- Schedule A (990) – Public charity status and public support.

- CP2100 or CP2100A Notice

- Form W-8BEN or W-8BEN-E

- Electronic and Paper Filing (Real Example Practice)

Note: All IRS Forms and Schedules will be explained Line by line and Box by box with huge no of real case studies and Tax implications.

- US Payroll Tax Practice in QuickBooks Online (USA): (10 Classes)

- Getting started with US Payroll

- Managing workers

- Wages and taxes

- Deductions and contributions

- Tax liabilities and end-of-period activities

- US Tax Practice in QuickBooks Online (USA) with Integration:

- Built-In Sales Tax Automation (US-based)

- Payroll Tax Integration (with QuickBooks Payroll)

- 1099 Filing Integration

- Third-Party Tax Software Integrations – Avalara, TaxJar and TurboTax

- Integration for Income Tax Planning

- QuickBooks online (USA) Bookkeeping and Payroll Accounting Practice with real client Data with Advanced and Elite Subscription.

-

Accounting Basic to Advance under US GAAP

- Accounting Basics

- Debits and Credits

- Chart of Accounts

- Bookkeeping

- Accounting Equation

- Accounting Principles

- Financial Accounting

- Adjusting Entries

- Financial Statements

- Balance Sheet

- Working Capital and Liquidity

- Income Statement

- Cash Flow Statement

- Financial Ratios

- Bank Reconciliation

- Accounts Receivable and Bad Debts Expense

- Accounts Payable

- Inventory and Cost of Goods Sold

- Depreciation

- Payroll Accounting

- Bonds Payable

- Stockholders’ Equity

- Present Value of a Single Amount

- Present Value of an Ordinary Annuity

- Future Value of a Single Amount

- Nonprofit Accounting

- Break-even Point

- Improving Profits

- Evaluating Business Investments

- Manufacturing Overhead

- Nonmanufacturing Overhead

- Activity Based Costing

- Standard Costing

-

Accounting For Accountant with AI Tools

- Bookkeeping automation: Zeni, Booke AI, Botkeeper

- Payroll management: Sage Copilot, Docyt AI

- Tax research & planning: TaxGPT, ChatGPT

- Audit & compliance: AutoAudit, Trullion

- Client advisory dashboards: Digits, Zeni, ZOOM Pro

-

Certification: (Mentor 100% Assist you to live to qualify) (Time based on Ur Demand

- QuickBooks Online (USA) Accounting Level 01 Certification

- QuickBooks Online (USA) Accounting Level 02 Certification

- QuickBooks Online (USA) Payroll Certification

- Intuit Trained Bookkeeper Certification

- IRS Tax Preparer and Tax Volunteer Training Assistance for Remote Tax Assistance Job & Intuit Payroll certification for Remote Payroll Manager Job under the supervision of a CPA (USA)

-

Profile Opening and Customizing with their Premium Service in Indeed & LinkedIn (Most Popular Remote Job Plat form for USA and Canada Job)

-

Mastering in Remote Job Interview based on different role.

FOLLOW OUR OFFICIAL FACEBOOK PAGE: https://www.facebook.com/rhcpatalent

Reviews

There are no reviews yet.